News

In the press: Denise Sidhu discusses opportunities & challenges faced by Ireland’s domestic VC & private equity ecosystem.

With more than two decades’ experience in venture capital,…

9th November 2023/by ines.sliskovic

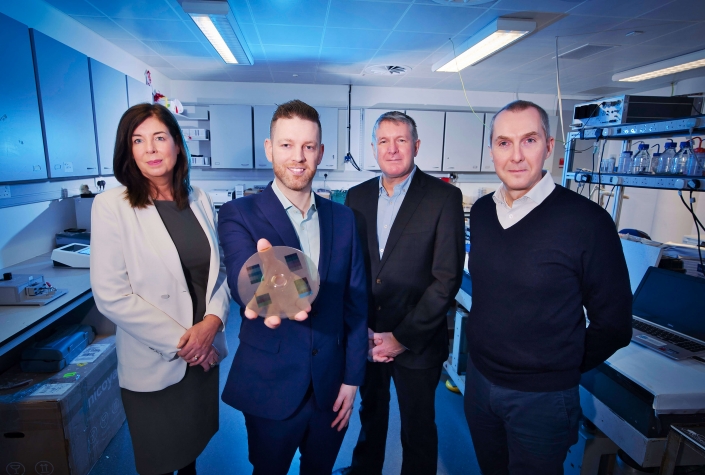

Cirdan secures £2.3m new funding to expand global operations

From Left: Niall Devlin, Head of Business Banking, Bank of…

12th October 2023/by granitewordpress

Denise Sidhu elected Chairperson of the Irish Venture Capital Association

Denise Sidhu, Partner & Director, Kernel Capital & Chairperson…

27th July 2023/by ines.sliskovic

Dublin-based Corlytics acquires UK’s Clausematch

Financial services software firm says deal will extend its reach…

5th July 2023/by ines.sliskovic

DisplayNote acquired by Volaris Group

From Left: Niall Devlin, Head of Business Banking NI at Bank…

3rd July 2023/by ines.sliskovic

Automated Intelligence sign major UK Government Deal

Automated Intelligence secures a two-year contract with the

Cabinet…

6th April 2023/by harisCabinet…

CORLYTICS AQUIRE ING’S SPARQ

From Left: Ger Goold, Partner, Kernel Capital & John Byrne,…

10th March 2023/by maira.duarte

Cirdan Imaging win Innovate UK’s best KTP Project

From Left: Paul Kavanagh, Cirdan, Jonathan Armstrong, Award…

27th October 2022/by maira.duarte

B-Secur & Datactics shortlisted for Belfast Chamber Business Awards 2022

Portfolio News – 23 September 2022

We are delighted to…

29th September 2022/by maira.duarteWe are delighted to…

Automated Intelligence awarded supplier place on UK Government’s G-Cloud 13 Public Sector Framework

Portfolio News – 26 September 2022

Bank of Ireland…

29th September 2022/by maira.duarteBank of Ireland…

€1.8M Investment in DCU SpinOut Pilot Photonics Limited

From Left: Frank Smyth, Co-founder & CTO, Pilot Photonics;…

24th March 2022/by tenpearls

Bank Of Ireland Kernel Capital Funds £1.5m Investment In Causeway Sensors

Kernel Capital through The Bank of Ireland Kernel Capital Growth…

15th March 2022/by granitewordpress

THE BANK OF IRELAND KERNEL CAPITAL FUNDS – €5M Investment in Altratech

Kernel Capital are pleased to

confirm that Altratech Ltd has…

13th December 2021/by granitewordpressconfirm that Altratech Ltd has…

The Bank of Ireland Kernel Capital funds Dundalk-based Nova Leah secures US Investment

Kernel Capital confirms, that through The Bank of Ireland Kernel…

9th December 2021/by granitewordpress

THE BANK OF IRELAND KERNEL CAPITAL FUND PORTFOLIO COMPANIES SWIFTQUEUE & ONCOMARK ACQUIRED

Kernel Capital confirm that

Dedalus Group, a leading international…

22nd November 2021/by granitewordpressDedalus Group, a leading international…

B-Secur Complete US$12m Fund Raise

Kernel Capital are pleased to confirm that portfolio company…

8th November 2021/by granitewordpress

Kernel Capital lead €1.5M investment in Kianda

The Bank of Ireland Kernel Capital Funds

Lead €1.5M Investment…

19th October 2021/by granitewordpressLead €1.5M Investment…